Expenses With Gst Entry In Tally . If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. Below are the various accounting entries under gst and how they can be recorded in tallyprime. Purchase entry with gst in tally can be passed in two ways: Accounting entries by business for your business to be gst. You can navigate the purchase. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. As a voucher and as an invoice. You will need to create an expense.

from caknowledge.com

Below are the various accounting entries under gst and how they can be recorded in tallyprime. Accounting entries by business for your business to be gst. If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. You can navigate the purchase. As a voucher and as an invoice. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. You will need to create an expense. Purchase entry with gst in tally can be passed in two ways:

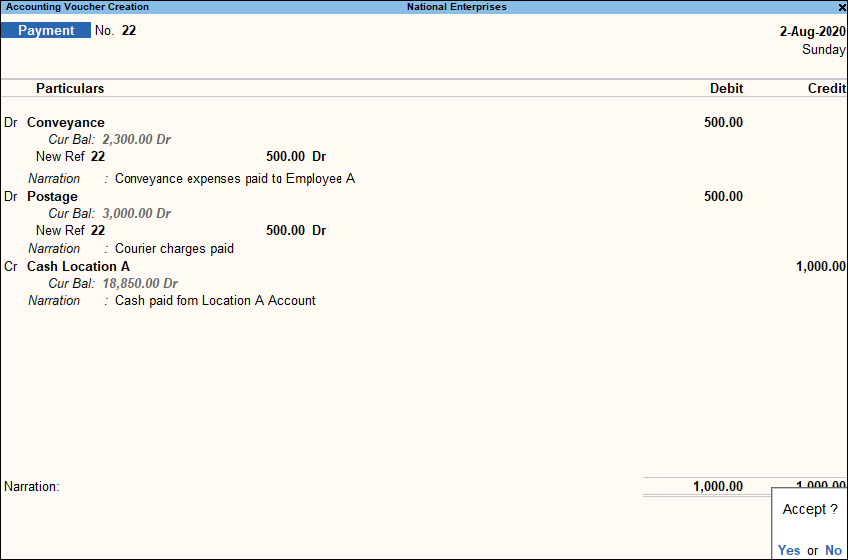

How to Pass Payment Entry in Tally Prime 2023? Screenshots

Expenses With Gst Entry In Tally As a voucher and as an invoice. You will need to create an expense. Below are the various accounting entries under gst and how they can be recorded in tallyprime. Accounting entries by business for your business to be gst. If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. As a voucher and as an invoice. You can navigate the purchase. Purchase entry with gst in tally can be passed in two ways: Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher.

From www.youtube.com

GST BANK CHARGES ENTRY IN TALLY BANK EXPENSES FOR GST TALLY GST Expenses With Gst Entry In Tally As a voucher and as an invoice. Below are the various accounting entries under gst and how they can be recorded in tallyprime. Purchase entry with gst in tally can be passed in two ways: Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. You will need to create an. Expenses With Gst Entry In Tally.

From www.youtube.com

GST indirect expenses entry in tally erp 9 6.1 with petty cash Expenses With Gst Entry In Tally You can navigate the purchase. Accounting entries by business for your business to be gst. Below are the various accounting entries under gst and how they can be recorded in tallyprime. If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. Purchase entry with gst in tally can be passed in two. Expenses With Gst Entry In Tally.

From vedcrm.vedantsoft.in

Set Up TallyPrime for GST Composition Expenses With Gst Entry In Tally If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. Purchase entry with gst in tally can be passed in two ways: You can navigate the purchase. As a voucher and as an. Expenses With Gst Entry In Tally.

From www.tallyknowledge.com

Tally Knowledge How to charge Freight, Transportation, Packing or any Expenses With Gst Entry In Tally If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. You will need to create an expense. If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. As a voucher and as an invoice.. Expenses With Gst Entry In Tally.

From www.youtube.com

gst in tally gst entry in tally erp 9 tally gst gst entry in Expenses With Gst Entry In Tally If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. Below are the various accounting entries under gst and how they can be recorded in tallyprime. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. Accounting entries by business for your business. Expenses With Gst Entry In Tally.

From help.tallysolutions.com

How to Record Expenses with GST in TallyPrime TallyHelp Expenses With Gst Entry In Tally If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. You will need to create an expense. Purchase entry with gst in tally can be passed in two ways: Accounting entries by business for your business to be gst. If you want. Expenses With Gst Entry In Tally.

From www.youtube.com

Purchase Entry with Multiple GST Rate in Tally ERP 9 in hindi YouTube Expenses With Gst Entry In Tally You will need to create an expense. Below are the various accounting entries under gst and how they can be recorded in tallyprime. You can navigate the purchase. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. As a voucher and as an invoice. If you want to record expenses. Expenses With Gst Entry In Tally.

From www.youtube.com

gst sales entry in tally how to create gst sales invoice gst bill Expenses With Gst Entry In Tally If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. Below are the various accounting entries under gst and how they can be recorded in tallyprime. Accounting entries by business for your business to be gst. Purchase entry with gst in tally. Expenses With Gst Entry In Tally.

From www.youtube.com

GST EXPENSES ENTRIES UNDER RCM METHOD IN TALLY YouTube Expenses With Gst Entry In Tally If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. As a voucher and as an invoice. You will need to create an expense. Accounting entries by business for your business to be gst. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal. Expenses With Gst Entry In Tally.

From www.youtube.com

gst in tally tally gst gst entry in tally erp 9 gst entry in Expenses With Gst Entry In Tally If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. As a voucher and as an invoice. You will need to create an expense. You can navigate the purchase. If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you. Expenses With Gst Entry In Tally.

From www.teachoo.com

How to Pass GST Entries in Tally Teachoo GST Accounting Expenses With Gst Entry In Tally Purchase entry with gst in tally can be passed in two ways: If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. As a voucher and as an invoice. You can navigate the. Expenses With Gst Entry In Tally.

From www.svtuition.org

GST in Tally.ERP 9 Accounting Education Expenses With Gst Entry In Tally You will need to create an expense. As a voucher and as an invoice. Purchase entry with gst in tally can be passed in two ways: Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. Below are the various accounting entries under gst and how they can be recorded in. Expenses With Gst Entry In Tally.

From www.tallyknowledge.com

How to Record Cash Expenses under GST in Tally (Reverse Charge)? Expenses With Gst Entry In Tally As a voucher and as an invoice. Accounting entries by business for your business to be gst. Tallyprime enables you to create an expense ledger and record expenses with gst in purchase, payment or journal voucher. You will need to create an expense. Purchase entry with gst in tally can be passed in two ways: If you want to record. Expenses With Gst Entry In Tally.

From www.youtube.com

tally GST ENTRY YouTube Expenses With Gst Entry In Tally As a voucher and as an invoice. Purchase entry with gst in tally can be passed in two ways: You will need to create an expense. If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. Below are the various accounting entries. Expenses With Gst Entry In Tally.

From www.youtube.com

Bank Charges Entry In purchase voucher tally erp 9 with gst itc YouTube Expenses With Gst Entry In Tally Below are the various accounting entries under gst and how they can be recorded in tallyprime. You will need to create an expense. You can navigate the purchase. If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. Tallyprime enables you to. Expenses With Gst Entry In Tally.

From www.youtube.com

multiple gst rate entry in tally prime purchase entry with multiple Expenses With Gst Entry In Tally Accounting entries by business for your business to be gst. Purchase entry with gst in tally can be passed in two ways: If you want to record expenses with gst in tally.erp 9, you need to enable gst in gateway. As a voucher and as an invoice. You will need to create an expense. Tallyprime enables you to create an. Expenses With Gst Entry In Tally.

From www.svtuition.org

GST in Tally.ERP 9 Accounting Education Expenses With Gst Entry In Tally If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. Accounting entries by business for your business to be gst. You will need to create an expense. You can navigate the purchase. As a voucher and as an invoice. Purchase entry with. Expenses With Gst Entry In Tally.

From www.techjockey.com

How to Record Sales & Purchase Entry in Tally with GST Expenses With Gst Entry In Tally If you are a registered dealer and purchasing from another registered dealer, and paid gst at the time of payment or purchase, you are eligible to claim the. Below are the various accounting entries under gst and how they can be recorded in tallyprime. Purchase entry with gst in tally can be passed in two ways: As a voucher and. Expenses With Gst Entry In Tally.